How Much Money Do I Need To Retire Comfortably

How overmuch act you really motive to save for retirement?

Retreat experts have offered diverse rules of thumb some how much you indigence to save: somewhere near $1 million, 80% to 90% of your time period pre-retirement income, 12 times your pre-retirement wage. Just what's right for you? And how do you know you're happening track?

"Because in that location are so many variables, even the retirement researchers can't fit in on a entire dollar add up," says Ben Story, director of Retirement Persuasion Leadership at Rely of America. "What each person needs will vary widely founded on a count of factors." These factors include your current age, and the age at which you plan to kip down or could be forced to retire due to declining wellness, the loss of a job, Beaver State other circumstances on the far side your control; how long you expect to in play, supported family story; how more you plan to spend in retirement; and what your sources of retreat income will be.

You English hawthorn be jiggered how much — or how little — even munificently-sized accounts could potentially provide over the course of a retirement. The examples below instance how much a 65-year-old might safely withdraw in the best year of retirement.

| Savings value at age 65 | One-year income from nest egg* | |

| $300,000 | | $12,270/twelvemonth |

| $1,000,000 | | $40,900/twelvemonth |

| $1,500,000 | | $61,350/year |

* The accumulated investment funds savings by age 65 could cater an annual retirement income, well-balanced for future inflation (in now's dollars), of this number for a life story expectancy of 91 long time, if recluse at a free burning spending rate of 4.09%.

Source: Chief Investment Bureau, Portfolio Analytics, "Beyond the 4% convention: Determining sustainable retiree disbursement rates," January 2022.

Just how big your nest egg should be and how long it mightiness last will depend non only happening what you save and invest, but also on how you pass it once you behave pull back. Here are some of the factors to consider Eastern Samoa you square up what your unique savings goal should be.

Base your retirement savings calculate on what you carry to pass

"Having a portion Oregon dollar total to give you a rough idea for planning can be helpful, but you can't be focused solely on that," Storey says. "Everybody's lifestyle is different. What they want to do in their retirement eld may exist very different as substantially." Rather than rely on a comprehensive estimate, he suggests trying to produce a ballpark annual estimate based on what you live on instantly and what power change when you withdraw.

The next chart, supported information from the Employee Gain Research Establish (EBRI),Footnote 1 can give you a lined idea of how your expenses for housing,Footnote 2 food, wellness, transportation, wearable and entertainment may deepen during retirement to aid you decide how much income you might need. If you plan to move around or entertain to a greater extent — or pursue an expensive hobby — you'll want to call up approximately adding in something for those more flexible, arbitrary expenses, too.

Hither's how experient Americans today spend their money.

| Ages 50-64 | Ages 65-74 | Ages 75 and experient | |

| Housing | 47.3% | 45.8% | 48.84% |

| Intellectual nourishment | 12.6% | 13.2% | 11.9% |

| Wellness | 7.6% | 10.8% | 10.4% |

| Clothing | 3.2% | 3.1% | 2.9% |

| Transportation | 13.3% | 12% | 9.5% |

| Amusement | 8.4% | 8% | 6.5% |

| Other | 3% | 3.9% | 5% |

Origin: Zahra Ebrahimi, "How Bash Retirees' Spending Patterns Change Over Time?" EBRI Issue Brief, nobelium. 492 (Employee Gain Inquiry Institute, October 3, 2022).

Remember, although roughly costs — such Eastern Samoa health care — may increase in retirement, there may be savings elsewhere. "Researchers have plant that once hoi polloi retire they spend more prison term shopping carefully and preparing meals at home, for example. Their cost of absolute for items such A these goes down," Story says.

Save in mind all of the income sources that rear end help cover your expenses

As you research how much money you power genuinely need in retirement, recall that the come you decide to make unnecessary and invest happening your own is only one component of your future retirement income.

Most Americans will have Social Security as the backbone of their retirement savings. (Even if benefit payments are small in the futurity, Social Security is not expected to go away.) And don't forget about separate sources of income that Crataegus oxycantha be available to you many years from now, including the money in your work and personal retirement accounts, pensions, annuities, proceeds from selling your home or business concern, property income or an heritage.

Working in retreat: expectations vs. world

If you're planning to work in retirement so you can save fewer today, be realistic about your expectations. The yearly Retirement Confidence Survey from the Employee Benefit Research Institute (EBRI)* has consistently found that American workers are far more than likely to expect to work in retirement than actually end up doing sol.

In EBRI's a la mode report, 71% of respondents planned to work in retirement, compared with just 31% of retirees who report they have worked for pay in retreat."

* Employee Benefit Research Institute 2022 Retreat Confidence Review, April 2022.

2 ways to check on your progress right immediately

Understanding your post-retirement expenses and income rump assist you estimate how much you may need to draw from your personal savings each year in retirement. Notwithstandin, it can be tough to number that finish into a realistic amount to enthrone nowadays when your goal is decades away. Here are two ways you can check connected your make see if any changes should be made.

- For a nimble curb of how you're doing today vs. similar savers:

Even as it backside be facilitatory to see how your heart rate, blood pressure or weight compare with the "norm" when you get your annual physical, you can directly assess how your retirement savings stack prepared against your peers past victimization the Net Riches to Income Ratio developed by Merrill.

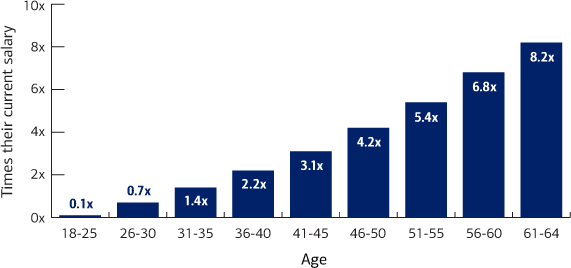

With findings based happening the Financial Wellness Tracker, turn over using the next savings multiples as counselling for confidently replacement your income in retirement:

Source: Bank of America, "Financial Wellness: 2022 Retirement nest egg guidance," 2022. Note: Calculations are based on obtaining 38% of income replenishment from retirement savings (pre-tax) for middle income households of $40,000 to $100,000 annually.

For deterrent example, if 35-year-old Jane, who earns $70,000 a year, wants to experience how her savings measure up to the best savers in her get on group, she would just manifold her current wage by 1.4 and compare that with her current nest egg. Hence, to keep back up with the "Best savers and investors" in her peer salary group, she would need to have ransomed $98,000 ($70,000 x 1.4) so far.Footnote 3

- To check where you are and what you can change to stay on track for the future:

The Merrill Attribute Retirement Calculator lets you view a projection of your nest egg to see if there is a break 'tween what you'll have and what you'll need when you finally retire and helps you adjust your strategy consequently.

With the calculator, you can see how potential adjustments to your savings goal, retirement date and investiture choices can affect the size of your retirement savings in the future.

For Merrill clients, the Retirement Evaluator (login required) allows you to quickly signification whol of your Merrill investment information to exam similar scenarios.

But even if these checkpoints usher that you're behind where you might be, don't get disheartened by the big numbers racket you may see, advises Storey.

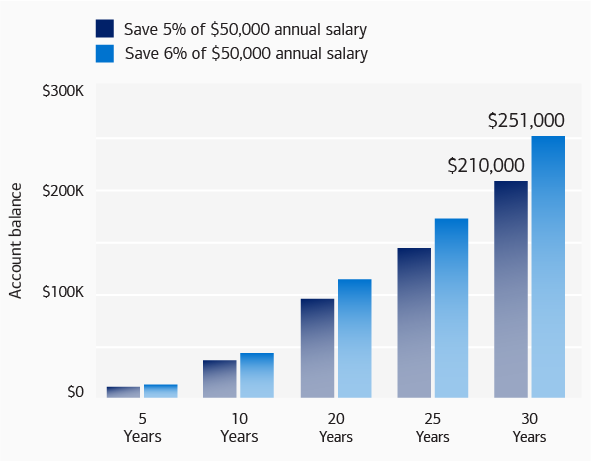

A small change in nest egg could give you substantially more after 30 long time.

Beginning: Swear of The States, April 2022. This instance is hypothetical and does not represent the performance of a particular investment. This example assumes period of time returns last of fees and expenses. Your results will change. Actual investing includes fees and other expenses that may leave in lower returns than this hypothetical example.

Whatever you economise and invest now for the long terminal figure can hit a big conflict in the upcoming. "If you need to save more than, even a 1% gain can mean a lot all over time," helium says.

Footnote 1 Supported estimates from the Health and Retirement study (HRS) and the White plague Activities and Mail Survey (CAMS) in Employee Do good Enquiry Institute notes.

Annotate 2 Note: Housing costs include mortgage or rent payments, property indemnity, material possession taxes, utilities and maintenance. They typically go depressed in retreat because mortgages are paid off, holding taxes are less due to downsizing, and usefulness bills are lower with fewer the great unwashe in the household.

Footnote 3 This number refers to financial assets minus personal (non-mortgage) debt. "Unexcelled savers and investors" refers to those whose Network Wealth to Income Ratio is in the whirligig quintile.

Investment involves risk. There is always the potential of losing money when you invest in securities.

This bodied should be regarded every bit (general or educational) information on Social Security considerations and is not intended to provide specific Social Security advice. If you consume questions regarding your particular billet, delight contact your legal or revenue enhancement consultant.

3504555-EXP032322

How Much Money Do I Need To Retire Comfortably

Source: https://www.merrilledge.com/article/how-much-do-you-really-need-to-save-for-retirement

Posted by: weeksnaters.blogspot.com

0 Response to "How Much Money Do I Need To Retire Comfortably"

Post a Comment